Let me take you back to a time over a decade ago, a time when my edges were laid, my ego was strong, and my trust in humanity was…misplaced. I was out visiting friends and family, glowing like a fresh tax return, when I noticed something was off with my credit card. You know that feeling you get when you check your bank account and think, “Wait…who went on this shopping spree? ‘Cause it wasn’t me.” That was me. On 10. This was not my finest hour.

It all started after lunch. A cute little restaurant with a chalkboard menu and free lemon water. That’s where I knew it happened. My ego couldn’t take it, someone had stolen my credit card number, and I was ready to launch an entire investigation powered by pink lemonade and righteous fury.

But wait, what if it was the store before the restaurant? Cue dramatic music. I turned into a one-woman fraud detective. Olivia Benson, but make it financial. I stormed back to both places, eyes narrowed, finger pointed, demanding to speak to someone (but not knowing who exactly I needed). I was asking cashiers, hostesses, and random bystanders, “Have YOU seen suspicious activity?!” People just stared at me like I was trying to return a rotisserie chicken to AutoZone.

Looking back now, I was out here doing the most when I should’ve just done the least and called my credit card company.

What I Learned (The Hilarious Hard Way)

Fast forward to today, and let me break it down for you like you’re a cousin at the cookout who just got their first real job and a shiny new credit card.

What Is a Credit Card, Anyway?

A credit card is like borrowing money from your future self, but with interest if you don’t pay on time. It’s also like walking around with a little digital treasure chest that fraudsters really want to get into. It gives you the power to buy that air fryer you’ve been eyeing or accidentally subscribe to 5 streaming services in one night.

The real gag? If something shady happens like unauthorized charges, credit card companies usually have your back.

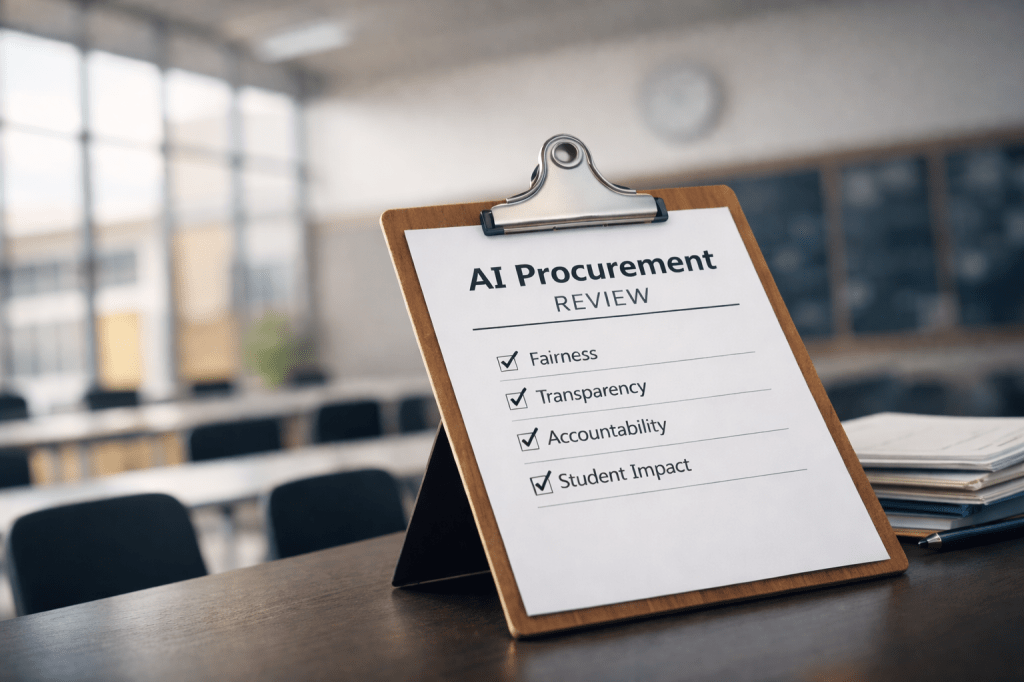

So What’s PCI DSS? Is That a K-pop group?

Nope, although it does sound kinda catchy.

PCI DSS stands for Payment Card Industry Data Security Standard, which is just a fancy way of saying: “Keep customer credit card data safe or face the wrath of compliance fines, lawsuits, and tech people giving you side-eyes.”

It’s like the rules of Fight Club, but for credit card data:

- Don’t store full card numbers unless absolutely necessary.

- Encrypt the data.

- Use secure systems.

- Train your staff so nobody goes rogue like I did.

If a business handles credit cards and doesn’t follow PCI DSS? That’s like using a screen door to guard a bank vault. You might get away with it for a while, but eventually…someone’s stealing lunch money.

Here’s What I Should Have Done Back Then

- Called the number on the back of my card. ( I did do this eventually)

- Let the fraud protection team work their magic.

- Got my money back and a new card sent via overnight delivery.

- Left the detective work to the people who don’t confuse SSL with SNL.

Today, if your card info gets swiped, most major credit card companies have fraud protection and zero-liability policies. That means you aren’t on the hook for fraudulent charges. They cancel the old card, send you a new one, and poof, problem solved.

No storming into restaurants. No suspecting everyone who made eye contact with you. No wild accusations, even though it’s possible it could have happened at a local restaurant.

Moral of the Story?

Protect your card like it’s the last slice of cake at a family reunion. But if something shady happens, don’t go rogue. Let your credit card company do what they do best: protect your pockets. And as for PCI DSS? Thank those rules next time your info stays safe. They’re the unsung heroes in the background, keeping your digits locked down tighter than Beyoncé’s album releases.

Now go swipe responsibly. And never accuse a barista of identity theft again.

Learn more about Click to learn more about PCI DSS Standards. Also contact your bank for details.

Leave a reply to Reach4MoJOYRn Cancel reply